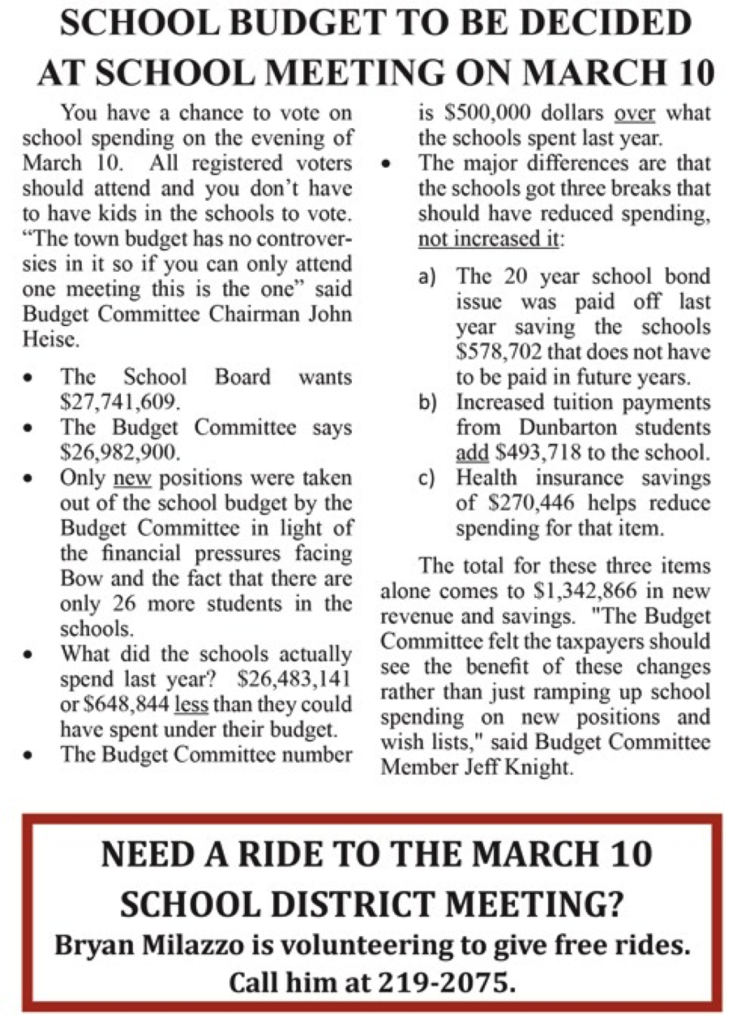

The School District’s Budget Meeting will take place on Friday evening, March 10, 2017 at 7:00 PM at the Bow High School. If you need a ride, please contact Bryan Milazzo at 219-2075

Category Archives: Article Archive

Budget Committee Chair Explains Spending Cuts

by John Heise

I felt it would be appropriate to share some insight into this year’s budget review so you may gain an understanding of what we do and how we go about our evaluation process. In addition, I would like to add some color around some of the proposed cuts this committee has recommended specifically about those involving the School Department.

This year certainly presents some challenges as we look to strategize over the recent Superior Court ruling awarding PSNH a victory with regards to their tax abatement. While it may be premature to put a nail in the proverbial coffin as the Supreme Court has agreed to hear/evaluate the case, we find it prudent as a committee to evaluate various outcomes should the tax abatement be upheld.

Here’s what we do know! The Town of Bow has been collecting property tax revenue based on a valuation that is greater than what the Superior Court has determined.

The court has determined the following values for 2012 and 2013, $67,566,774 and $67,362,827 respectively. During that same period, the Town of Bow had valuations of $195,842,087 and $161,431,587.

If the lower court’s ruling is to be upheld this would call for a refund along with accumulated interest of approximately $8.5 million dollars. In addition, it should be noted that PSNH is also seeking an abatement for 2014 and 2015, and we fully expect 2016 to follow. Those additional years may present an additional liability of another $4 million dollars for a total of approximately $12.5 million in tax refunds and accumulated interest.

What does that mean? If these refund dollars were to be deemed due in one year i.e.; $12.5 million dollars due now, that would translate to an increase of $10.78 p/$1,000 to the tax rate. On a home valued at $300,000 that would mean an additional $3,234 due in one year in a worst case scenario. In addition, it should also be noted that many families in Bow have mortgages on their home for which many escrow their tax payments. This may place additional financial pressures on those individuals as each bank must perform an escrow analysis to adjust for any shortfall in tax collection and remittance.

Refund dollars only part of the problem! In addition to the amount potentially due as a refund, we most likely must contend with a reduced valuation in future years. If the valuation determined by the Superior Court stands and/or, if, and when, PSNH assets are sold at auction in the spring, a new value will be determined. This new value will most likely be lower than what we have currently booked for valuation and we estimate that to equate to an increase in the tax rate by approximately $.79 p/$1,000. On a home valued at $300,000 that would translate to an $237 p/yr. in additional property taxes going forward.

Certainly, the PSNH valuation issue is of paramount concern to our committee but these are not the only issues facing our community. In addition, our Elementary School needs some major repairs, projected to cost around $3 million dollars and we have underutilized properties in town like the Community Building, etc. that have drawn interest.

How does this all relate to our process? Each year the Budget Committee meets in January and February to review both the Town Budget as well as the School Budget. This is an interactive process between town and school officials. Our committee goes line by line though each department for both the proposed Town Budget as well as the School Budget, to discover potential savings. In most recent years there has been some great strategic initiatives by both the Town and School Board to reduce their budgets. These initiatives include the movement to higher deductible health plans at both the School and Town, conservative spending policies, as well as the movement of our police dispatch to the county.

Extraordinary times seek extraordinary measures! Although substantively that may be true I am not sure that tells the full story. To mitigate the effects of this litigation as well as a quest for a stable tax rate, we as a committee are looking hard at every budget item. With respect to the School Budget, last year we basically agreed to the same number but this year is a little different and for the following reasons.

First, let me say that we believe our great school system is the leading reason why people choose Bow over many other communities and is the reason my family chose Bow. There are some moving parts in this year’s budget that have raised concern for the budget committee.

The budget presented to the Budget Committee had a total appropriation of $27,366,857 for 2017-2018 School year. 2016-2017 had a total appropriation of $27,426,119, a difference of $59,262. At first glance you would say great a budget decrease! However, what is missing from the equation is the fact that the High School Bond Payment of approximately $850,000 has been eliminated, we have additional revenues from Dunbarton of $520,000, and some savings from the switch to a Higher Deductible Health Insurance Plan of $270,446, inclusive of an increase in the GMR (Guaranteed Maximum Rate) Increase of 11.5%. The above additional revenue and reduced expenditures total approximately $1,640,000.

We do concede that there are additional expenses, some unexpected such as an increase in the Retirement System of $257,992, and those expected, like 2% negotiated wage increase for BEA & BESS union contracts and non-unionized employees in the amount of $469,559.

That amount also includes newly proposed staff. In addition, with the retirement of the bond a reduction in building aid has be realized in the amount of $249,442. These items total approximately $975,000.

The above analysis is not meant to be inclusive of all budget factors but designed to highlight the major items. The difference between these two numbers total $665,000 ($1,640,000-$975,000).

Another factor we looked at was the difference between the Approved Budget and Actual Expended for the last couple of years.

2014-2015 Approved Budget $26,344,942,

Actual Expended $25,749,662, ($595,280 under), -2.31%

2015-2016 Approved Budget $27,131,986,

Actual Expended $26,483,141, ($648,844 under), -2.39%

We absolutely appreciate the prudent spending nature of the administration and we also concede that these monies do go back to the taxpayers at rate setting time in Oct. However, it also shows that by reducing the school budget we feel comfortable knowing they will still be able to deliver the high-product we have come to value.

We have provided a summary of suggested reductions in a separate attachment and support our recommendations. To highlight a few, you will notice we have kept the Full Day kindergarten program, Co-Curricular and athletic programs, the Chinese program, and agreed to some additional staffing including a new Assistant Principal at BES.

This has certainly been a challenging year and we anticipate additional challenges over the next few. I would like to thank my fellow Budget Committee members and of course our recording secretary Wendy Gilman, the Board of Selectman, the School Board, Town Administration, and the School Administration for their involvement in this process this year.

John Heise has been chair of the Budget Committee for the last four years.